Supply Chain Trends for the Pet Industry and Future Prospects

If you are a basic pet owner, you probably go to your local food or supplies store to pick up your pet’s stuff. But have you ever given thought to how your pet’s food or other supplies got into the store? What you probably have no idea about is that typical pet food may take close to a year to be transformed from raw ingredients to what it is at the moment.

How does it work?

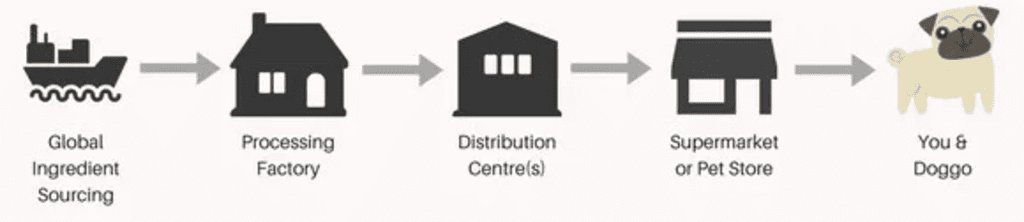

A typical pet product supply chain works as follows. Ingredients are sourced globally in order to take advantage of economies of prices across different geographies. For instance, it may be cheaper to source raw materials for the manufacture of leashes from China, than in Australia.

Raw material ingredients are then processed in factories. The by-products are then packaged up and moved to distribution centers depending on their nature and distance to the final destination. For instance, once pet food is manufactured, its packaged, and shipped to the retail location before being stacked on shelves for weeks or months awaiting purchase.

While the need for maintenance of pet health is critical, many of the critical naturally occurring vitamins may be lost when their shelf life is prolonged. This is why the majority of stable pet food is filled with minerals and vitamins to prolong their shelf life.

Here are the Latest Trends in the Pet Market from a Supply Chain Perspective

The trends along with the stemming issues for pet food and supplies have lately become a growing concern.

Effects of the covid-19 Pandemic

Euromonitor, an effective tool used to track tracked effects on stock and pricing status arising from the covid-19 pandemic in major worldwide markets including Western Europe, France, Germany, Italy, and the U.K indicates an average increase in demand for pets to 12.1% in March 2020 from 5.3% in February same year.

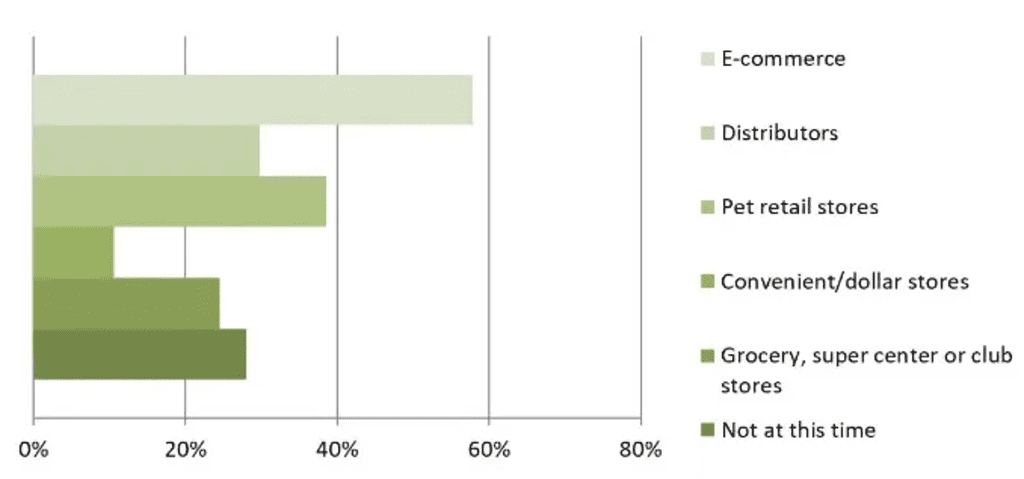

Similarly, a survey conducted for manufacturers in the U.S. in April 2021 suggested an increase in demand for pet products arising from panic purchasing. However, a minority (10%) of those surveyed witnessed no major impacts. The extent of the positive impacts arising from the effects of COVID-19 on the pet products supply chain channel is as shown below.

Aggregate Consumer Spending in the Pet Supply Chain

According to Bureau of Labor Statistics Consumer Expenditure Surveys, the resilience of the pet industry reflected the critical roles of affluent households. Arising from the trend in 2014, more than 70 thousand households in the U.S. accounted for aggregate pet markets in the year 2020. These statistics are inclusive of 64% of food spending, 70% of spending on non-medical supplies, 59% of veterinary spending, and 61% of pet supplies spending.

Pet Toy Sales

The demand for pet toys has ballooned over the past decade. Pets are currently considered part of the family by their pet parents. This trend has largely encouraged equal treatment of pets as any other member of the family. This has consequently increased luxury spending on pets. Future Outlook by Future Market Insights predicts pet toy sales to grow at a CAGR rate of 7.2% between 2021 and 2031.

Pet Wearables

Dogs have over the years gained much popularity and as result dog collars, harnesses, and leashes have become a critical requirement for owners. This has resulted in a thriving dog leash, collars, harnesses, and collars global markets witnessing substantial expansion globally over the past 10 years. Prolonged industrial and technological transformation breakthroughs have additionally created great opportunities for the global pet wearables industry.

Supply Chain Segments for Pet Wearables

The supply chain segments dominating the leashes, dog collars, and harnesses markets comprise electronic collars which are utilized to monitor heart rate, temperature, location, and position of pets. Others include back-clip harnesses, utilized as walking equipment and considered to offer the most comfort. These products are anticipated to significantly grow in the near future. Statistics indicate that the worldwide dog leashes, harnesses, and collar market are expected to attain a valuation of $5,000 and above by the end of 2022.

Pet Food Products

Pet food and treats are considered to be the most vital products within the pet industry. This is because food and treats satisfy the nutritional needs of a pet thus ensuring well-being and health. This implies that a pet can survive without its toys, as much as it might be a little sad, it can’t live without food and nutrition.

Classifications of Pet Food

Depending on the water content, pet food can either be classified as dry or semi-moist. Semi-moist food has higher palatability as compared to dry food and it’s convenient to serve. Semi-moist food also provides very high energy levels to pets. However, semi-moist food is extremely expensive and spoils at a fast rate due to its higher water content as compared to dry food. It also has higher sodium and sugar levels, which affects the dental hygiene of pets. Dry pet food includes biscuits and mixers, extruded foods such as shaped pellets, and flake foods such as flaked cereals. Dry food has disadvantages like relatively lower palatability and a higher likelihood of containing preservatives.

Supply Chain of dry Pet food

The supply chain of typical dry pet food entails the sourcing of ingredients from different geographical locations while considering the price factor. The ingredients are then processed and manufactured at high temperatures in factories. This is meant to ensure the removal of moisture, hence facilitating long shelf life. An extended shelf life offers various benefits to the manufacturers. These include reduced wastage and product returns from retail stores.

Upon manufacturing, the food is usually packaged and transferred to various distribution centers, which depend on the final destination of the products. The food is then shipped to retail locations where it may stay on shelves or fridges, depending on the storage instructions of the manufacturer, till they are finally purchased.

Manufacturers of pet food tend to face disruption within the supply chain, especially due to increased demand. Therefore, to ensure effective mitigation of the issue mentioned above, experts within the pet food industry propose long-term production planning by the manufacturers, to provide unlimited services to their consumers.

The Future

Future global prospects reflect strong growth across all sectors within the pet industry. (,,) predicts the retail side of pet food/treats as well as non-food supplies to experience a 14% increase to approximately $ 30 billion and $58 billion respectively. A faster rate of growth is expected to reflect in online sales. The growth of the global health supply chain sector on the other hand is expected to exceed that of the pre-pandemic years, increasing by 8% to $38 billion. On the other hand, the supply chain of non-medical supplies is expected to continue its recovery process after the pandemic period. Notwithstanding, the product and supply pricing challenges globally for the pet industry are expected to be at full speed.